Changes To The CIMA Syllabus

When and why does the syllabus change?

Changes to the CIMA syllabus are designed to keep the CIMA qualification up to date and as relevant as possible in the modern world. This ensures the qualification that you receive is viewed as a respected and comprehensive qualification.

The most recent professional level syllabus update came with the introduction of the 2019 syllabus. This update used the previous (2015) syllabus as its base level. The impact of changes varied between each of the specific exams. We’ve provided more details about the changes between the 2015 and 2019 professional level syllabus further down this page.

In 2017, CIMA certificate level received an update. This significantly changed the structure of the qualification and resulted in 5 exams being reduced to 4, with content from the previous syllabus distributed across the new exams.

CIMA always provide plenty of notice for any future updates to the syllabus, reducing the impact on current students. CIMA typically release a transition guide with any new syllabus to help students find the best path between the old and new exams.

What changed with the 2019 professional level syllabus update?

In the 2019 syllabus update, CIMA has recognised the importance of digitalisation within the world of finance. Here are the reasons behind CIMA’s overhaul of the old syllabus and how it will help you in your accounting career:

- Future-proofing accountants

- Keeping content relevant

- Increase your employability

To find out more details about the syllabus itself, including how it affected each module, download the CIMA syllabus document. You can also view the full re-inventing finance for a digital world white paper here.

Here’s how each exam was affected…

To help you get to grips with the CIMA 2019 syllabus, our tutors created a summary of the key changes from the 2015 syllabus.

This diagram shows all modules, with green highlighting modules that have received minimal change, red highlighting those that received significant change and orange where there was relatively minor change.

CIMA E3

New content & some old content dropped

CIMA E2

New content added & old content dropped

CIMA E1

New content & orientation

CIMA P3

New content & some old content moved to F3

CIMA P2

Same broad areas but with digital focus

CIMA P1

Same broad areas but with digital focus

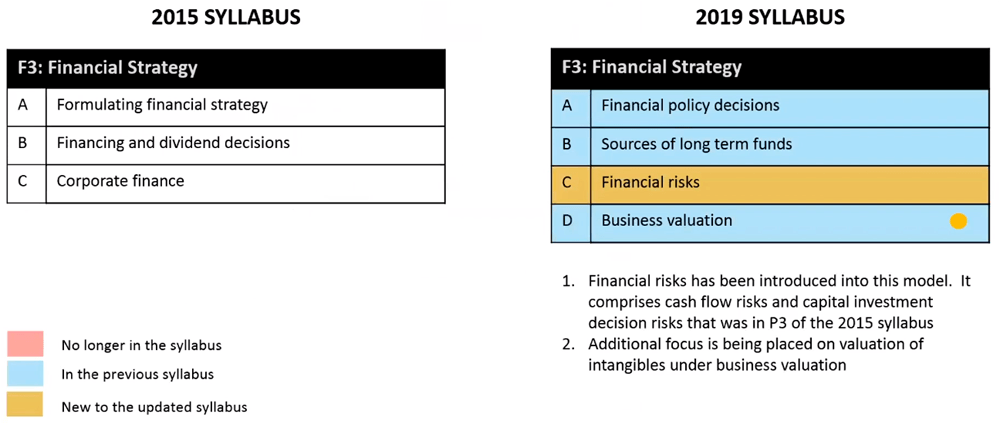

CIMA F3

New content from P3 & digital focus for old

CIMA F2

New content & digital focus for old content

CIMA F1

Minimal change

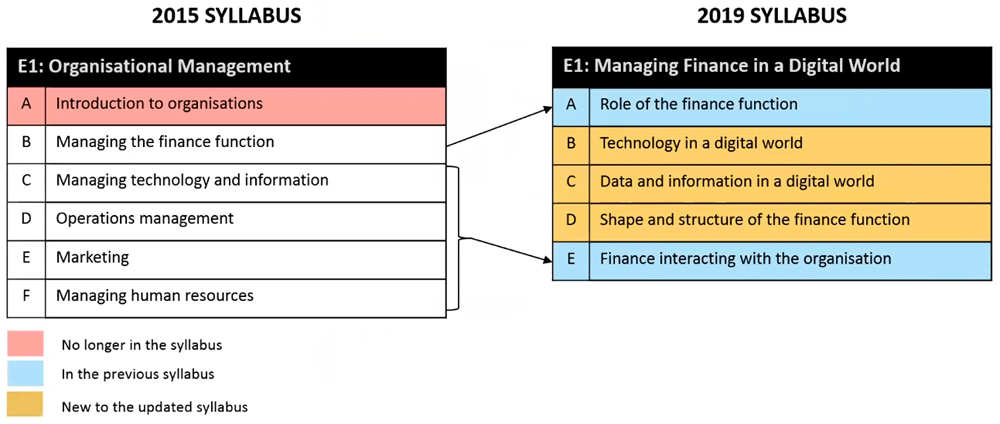

CIMA E1 – Managing finance in a digital world

The focus of the E1 syllabus has changed considerably. The main additions cover developments in data use, new technologies and the increasing role each of them play in modern business management. The 2019 syllabus explores their importance and value for the finance function. Parts of the syllabus focused on non-finance areas such as HR and Marketing have also been adjusted to focus more on how a finance professional would interact with and support these business areas. Finally, a number of topics such as change management have been removed from the E1 syllabus.

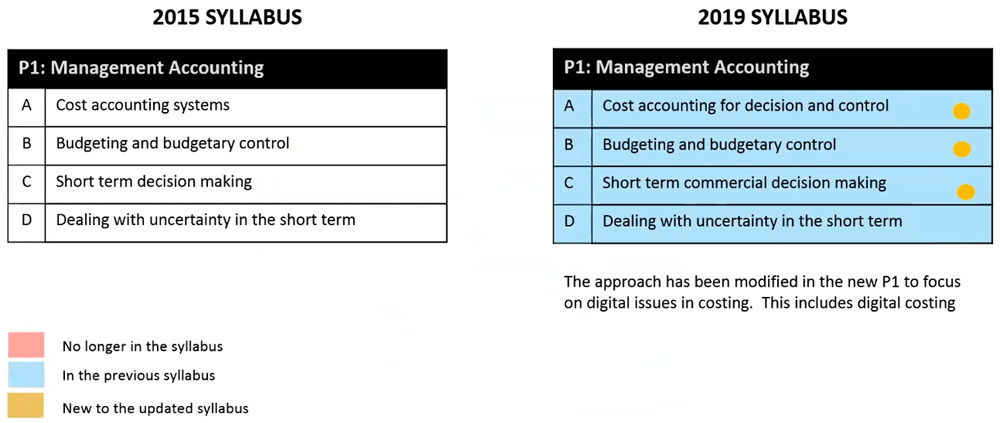

CIMA P1 – Management accounting

The broad areas of the P1 2019 syllabus remain fairly similar to the 2015 syllabus, however, a general theme running throughout is a greater focus on digital issues in costing.

Some specific areas such as TQM and JIT are no longer examined, and new areas such as big data analytics, stress testing budgets and the use of computer or spreadsheet planning models to assist decision making, have been included.

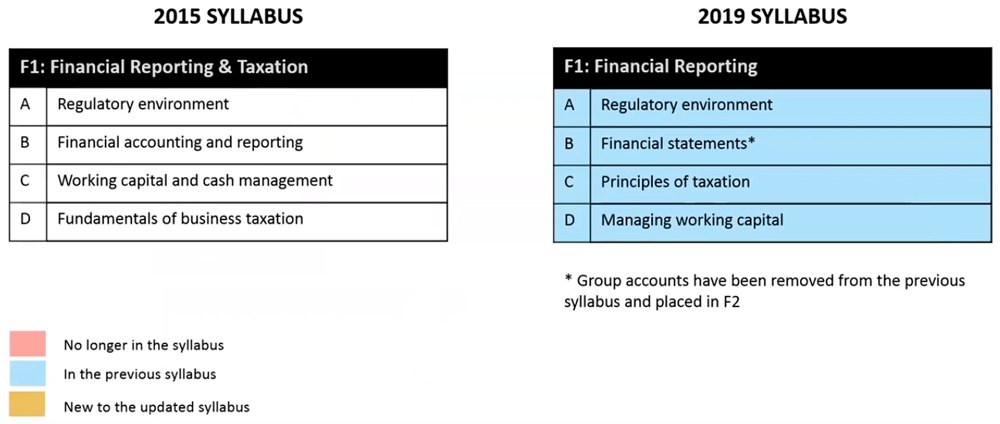

CIMA F1 – Financial reporting

The 2019 F1 syllabus has been substantially revised with the complete removal of consolidated accounts. Additionally, several key standards (IAS 8, IAS 21, IAS 34 and IFRS 8), intangibles assets (IAS 38), employee benefits (IAS 19) and external audit have all been removed.

The only new content is IFRS 17 Leases which is examineded from the perspective of the lessee.

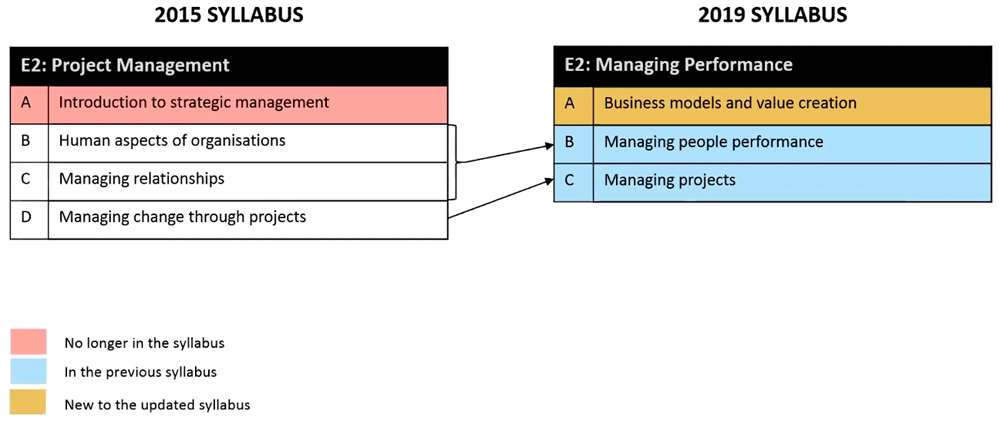

CIMA E2 – Managing performance

The broad themes of the 2019 syllabus are similar to that of 2015, although there is a greater emphasis on business models and value creation whilst the focus in the human aspect of the syllabus has become focused on the management of people.

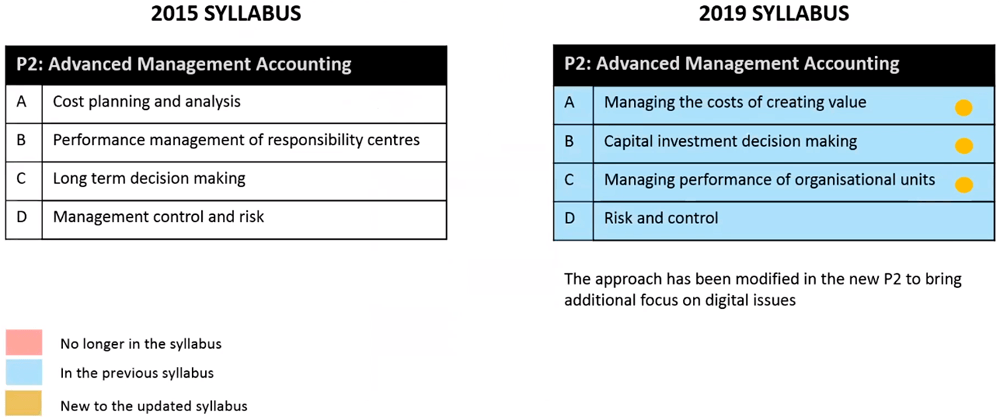

CIMA P2 – Advanced management accounting

The P2 syllabus remains largely unchanged. However, some specific parts are redcued or removed such as learning curves and budgeting.

In 2019 syllabus, there is more focus on responsibility centres and activity based management.

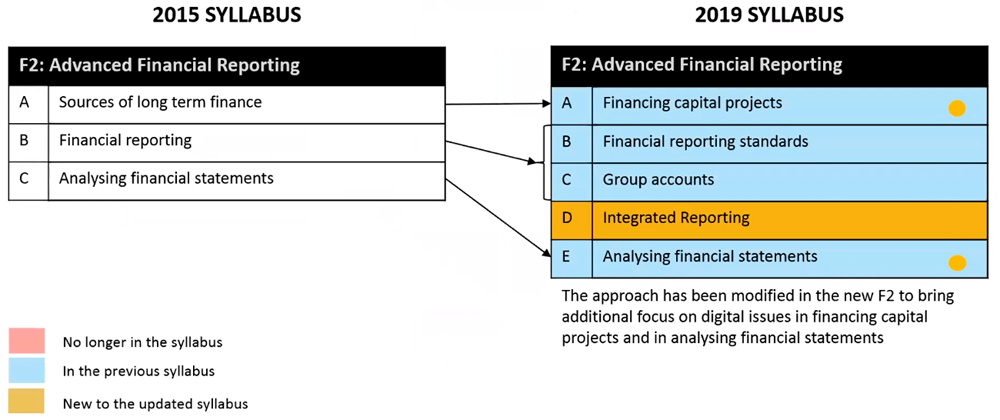

CIMA F2 – Advanced financial reporting

The removal of group accounting from the new F1 syllabus means that the introduction to and production of consolidated financial statements, features more prominently in F2. Topics like group disposals have been removed.

There are also several changes to accounting standards to reflect the real life updates to some of these standards in the old syllabus. For example IAS 18 Revenue, which has been replaced by IFRS 15 Revenue from Contracts with Customers. Finally several new topics have been included such as IAS 38 Intangible Assets (previously featured in F1) and Integrated Reporting (previously featured in F3).

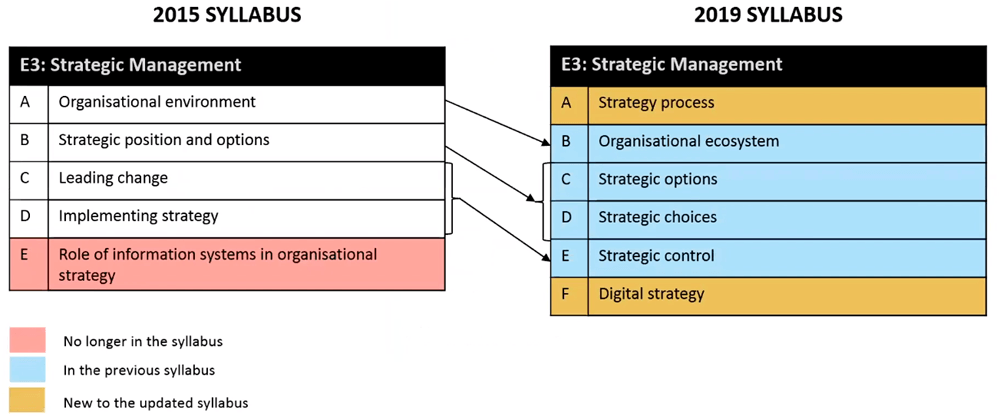

CIMA E3 – Strategic management

As the 2019 syllabus continues to look at the management of an organisation’s strategy it is very similar to the previous syllabus.

However, what is new to the syllabus is it’s focus on an organisation’s digital strategy and the way that new technology has impacted on it.

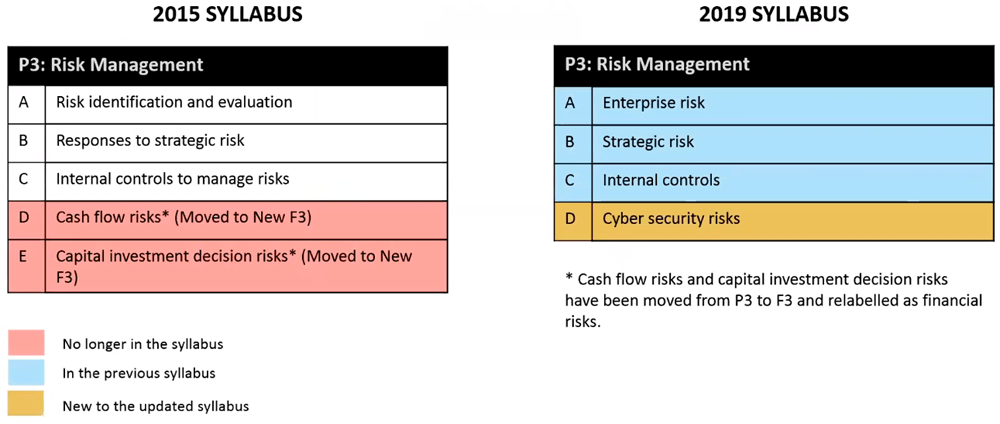

CIMA P3 – Risk management

CIMA F3 – Financial strategy

F3’s content has remained mostly the same with some additions. First and foremost, there is a smaller focus on hedge accounting (reporting). In addition to this, F3 has absorbed the content that has been removed from P3 – financial risk and hedging techniques (greater depth).

In short, F3 has been kept very similar but with an even greater focus on the strategic applications of financial accounting.